This post features insights from our most comprehensive analysis of digital content marketing to date — The Content Marketing Paradox Revisited. Download your copy to learn from our analysis of 12 months of marketing activity from 22,957 brands and 50 million pieces of content across all major industries.

When we first introduced the idea of the content marketing paradox — generating more content with less return — we used an analogy most of us can relate to: watching TV.

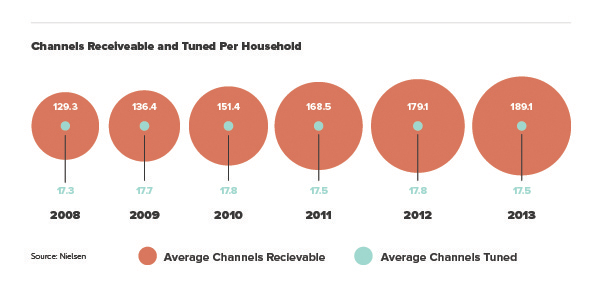

Here’s the quick version: Over the last 20 years, the number of television channels available to the average American household quadrupled. Across that same period, however, both the total amount of TV consumed weekly and the average number of channels watched per household held steady at just 17.

Or, as Nielsen proclaimed: “AMERICANS VIEW JUST 17 CHANNELS DESPITE RECORD NUMBER TO CHOOSE FROM.”

The marketing version of this headline might as well read: “AMERICANS VIEW JUST [Enter Depressing Statistic Here] POSTS DESPITE RECORD NUMBER TO CHOOSE FROM.”

… because until technological advances allow humans to consume content more quickly, competition for viewer attention is only getting steeper. So just how hard is it to be heard above the noise, and how does content marketing strategy need to change to stay effective?

To find out, we expanded our research on the state of digital content into our most comprehensive analysis to date. We used the TrackMaven software platform to analyze the impact of 12 months of marketing activity for 22,957 brands across all major industries. Collectively, this analysis included 50 million pieces of content across six digital marketing channels — Facebook, Twitter, Instagram, Pinterest, LinkedIn, and blogs — with a combined total of 75.7 billion interactions.

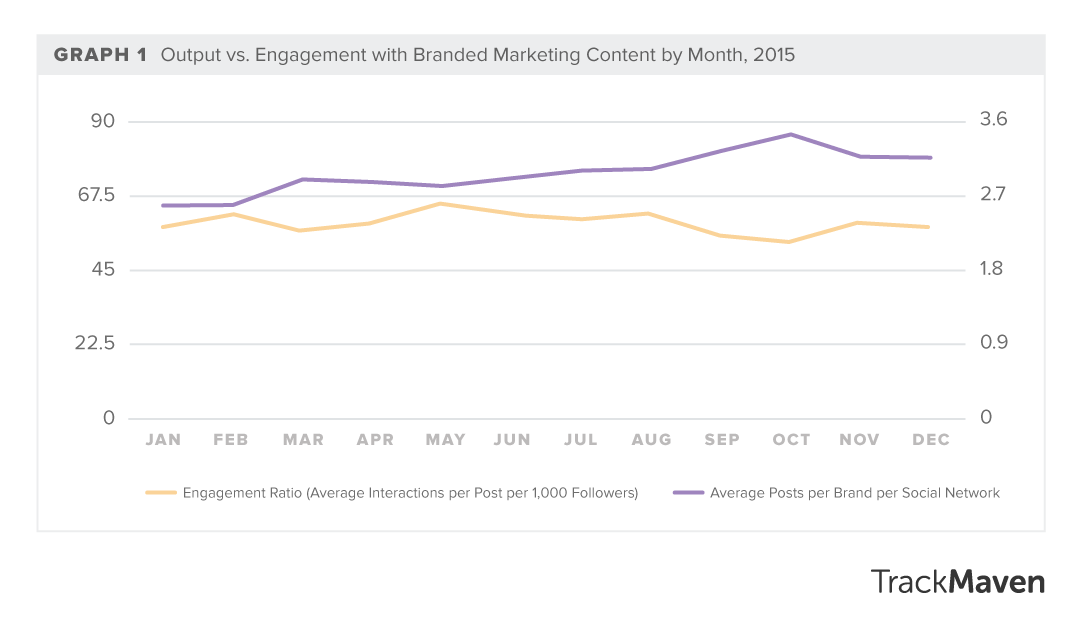

Take a look at the overall impact and output per brand in this summary chart from our report, The Content Marketing Paradox Revisited.

Right off the bat, the overarching trend is obvious: we’re still producing more content with less return. That purple line chugging upwards? It reflects the output of content per brand per social network per month in 2015. The orange line trending downwards? That’s the engagement ratio per brand per social network. (We measured the engagement ratio as the average interactions per post per 1,000 followers to normalize for differences in audience size and posting frequency among brands.)

Why is it getting harder to make an impact with content marketing?

From the highest to lowest points, the output of content per brand increased 35 percent per channel across 2015, but content engagement decreased by 17 percent.And most interestingly, when output per brand peaked in October 2015, engagement levels look the sharpest downturn.

In short: This is content overload, quantified. As more content floods social networks, the slice of engagement for the average brand shrinks. With a limit to how much content can be consumed, liked, or shared, brands must create their own competitive advantages with distinguishing content.

Two major marketing headwinds: monetization and mobile

As we outline in our report, two interrelated trends — the rise in mobile content consumption and the monetization of social networks — have made marketers’ jobs harder.

In the United States alone, adults spend 5.6 hours a day on Internet-connected devices, more than half of which (2.8 hours) is spent on mobile devices. Just 5 years ago in 2011, American adults spent less than an hour per day on mobile devices. What’s more, the average U.S. smartphone user now spends 88 percent of his or her time when using a mobile phone within an app, and just 12 percent using the web browser.

In other words, we are frequent, frenetic Internet grazers, and mobile apps are our pastures. Facebook, Twitter, and Instagram all rank among the top 10 mobile apps by usage. Facebook and Twitter also rank among the top 10 apps by number of sessions. And newer networks like SnapChat (with 2 billion story views per day!) are quickly climbing the ranks.

But the social networks themselves are implementing new ways to turn a profit off of all this time we spend in mobile apps. Facebook, for example, saw $5.6 billion in ad revenue in 4Q2015, 80 percent of which came from mobile ad sales. As newer networks fight to monetize, watch these metrics; soaring ad revenue may well be the Grim Reaper of organic reach, but if brands are forced to pay to play, it better be worth their while.

How do marketers get past the content marketing paradox?

First and foremost: We must raise the bar for in-platform content. The social networks themselves are forcing our hands on this front. Just look at Facebook Instant Articles; “shop now” and “buy it” buttons on Instagram and Pinterest; autoplay video content on Twitter and Facebook; and SnapChat Discover, which delivers curated stories from media companies to users’ feeds. Across the board, these changes are aimed at keeping users happy and engaged in the platform, not sending them elsewhere.

For marketing teams, implementing a platform-specific content marketing strategy will require more intentional use of resources, more creativity, and more budget. But the teams taking the time to be intentional will outperform those that are spraying and praying every time.

The second component: It’s time to pay to play (on some networks). Spoiler alert: engagement per brand dropped on every major social network except Twitter in 2015. We cover channel-specific trends in more detail in our report, including the average posting frequency and engagement rates on social networks and blogs.

Is your team ready to implement a platform-specific content marketing strategy? Download your copy of The Content Marketing Paradox Revisited to find out where brands are generating the most content but getting the least for it, see and examples from brands that are outperforming today.